Has “Return-to-Office” Impacted Vehicle Miles Traveled?

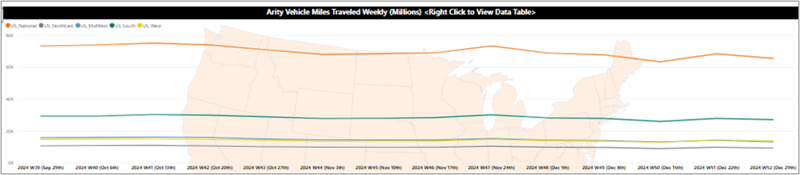

Given the scale of this shift, we wondered if the RTO mandate would impact Vehicle Miles Traveled (VMT). VMT was fairly stable throughout 4Q2024 (Figure 1). Recognizing that holiday-related driving fluctuations are likely, we analyzed state-level daily VMT data from December 28, 2024, to February 22, 2025 as limiting the analysis to the winter reduces seasonal variation.

Figure 1: Arity Weekly VMT, Sept. 29, 2024-Jan. 4, 2025. TrendLensTM

Examining VMT in Washington, D.C.

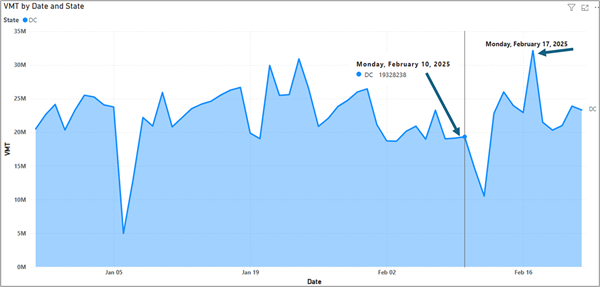

The Washington metropolitan area has a population of about 6.3 million as of 2023. There are about 190,000 federal workers based in D.C. (3.0% of the population), of whom 71,000 live in Washington, D.C.2 The aggregate VMT data does not show a clear spike on February 10, despite thousands of employees presumably having to return to in-person work. In fact, traffic volumes dropped the following day due to a snowstorm on February 11. However, we observed that Monday, February 17 marked the highest VMT level in the past two months, potentially linked to the RTO mandate (Figure 2). Yet, this increase was short-lived and VMT declined afterward.

Figure 2: Arity Daily VMT in the District of Columbia, Dec. 28, 2024-Feb. 22, 2025

Looking at Regional Trends

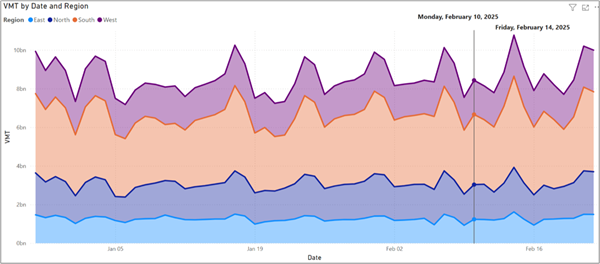

When we zoom out to examine regional VMT trends (Figure 3), we find Valentine’s Day as having the highest spike in VMT (perhaps many area residents went on dates and then to local ski resorts for the weekend). However, we do not see any significant increases that can be directly attributed to the RTO mandate.

Figure 3: Arity Daily VMT by U.S. Region, Dec. 28, 2024-Feb. 22, 2025

A Nationwide Perspective

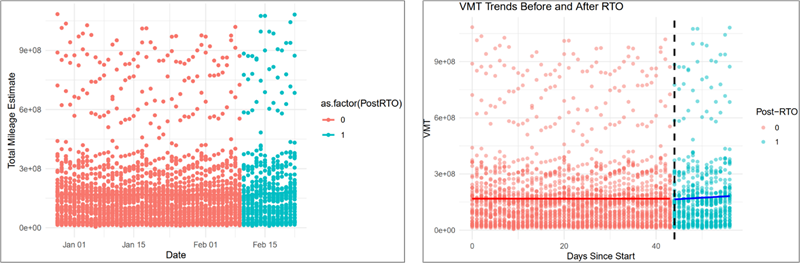

Taking an even broader view, Figure 4a presents a scatterplot of daily VMT across all states. Each dot represents a state’s daily VMT, with red dots indicating pre-RTO data and blue dots representing post-RTO data. The data appear highly scattered, without a clear trend.To better visualize any potential shifts, we applied linear trend lines for the pre- and post-RTO periods (Figure 4b). A closer look reveals a slight upward tilt in the post-RTO trend (blue line), suggesting a minor increase in VMT.

Figure 4a: Scatterplot of Arity Daily VMT by State, Dec. 28, 2024-Feb. 22, 2025 and

Figure 4b: Scatterplot of Arity Daily VMT by State with fitted trendline, Dec. 28, 2024-Feb. 22, 2025

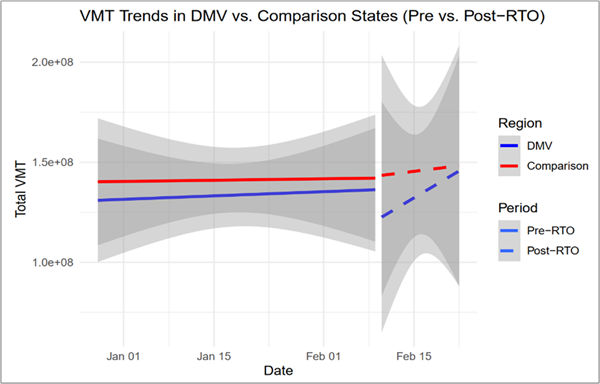

Comparing the DMV Region to Other States

There are about 2 million federal workers, 80% of whom live outside the DMV. Another way to assess the RTO mandate’s impact is by comparing the D.C.-Maryland-Virginia (DMV) region to a control group. To do this, we selected three states: Alaska, Tennessee, and Arizona. These states have lower proportions of federal employees relative to the overall population: 1.3% for AK, 0.4% for TN, 0.4% for AZ (9,800 federal employees reside in AK, 28,700 in TN and 30,600 in AZ3).Figure 5 illustrates this comparison, with daily VMT for the comparison states represented by the fitted red line, and daily VMT for the DMV region represented by the fitted blue line (the gray bands indicate the 95% confidence intervals for each group’s fitted line). After the RTO mandate (indicated by the dashed lines), the comparison states experienced a slight increase in VMT while the DMV region experienced a sharp rise after February 11, most likely due to the snowstorm rather than the RTO mandate itself. However, the difference in pre- and post-RTO VMT in either region is not statistically significant.

Figure 5: Arity Daily VMT Comparisons between DMV and AK/TN/AZ, Dec. 28, 2024-Feb. 22, 2025

Conclusions

We also conducted various regression and Difference-in-Differences analyses to quantify the RTO mandate’s effect on VMT. However, due to ongoing federal layoffs and the relatively small proportion of federal employees in the total driving population, we were unable to reach a definitive conclusion on its quantitative impact.

What we can say with confidence is that, at the national level, the RTO mandate does not appear to have significantly influenced overall VMT. While there may be localized effects—such as temporary spikes in D.C. traffic—the overall impact on U.S. driving patterns is minimal, with only a slight increase observed.

When considering other factors, a few things come to mind:

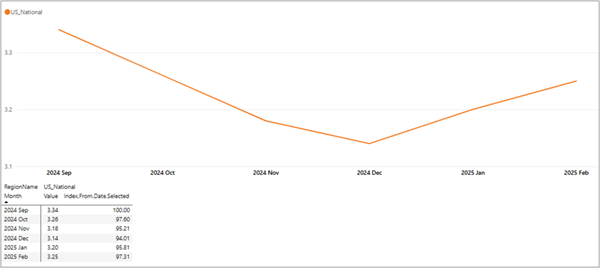

-- Gasoline prices are unlikely to have had much impact on VMT as they have been stable this winter, rising only slightly from $3.14/gal in December to $3.25/gal in February (note the gradual decrease from $3.34/gal in August in Figure 6).

-- National VMT for the study period was 0.98% lower than for the prior year, suggesting that VMT for the study period has otherwise not been subject to other external shocks.

Figure 6: Average National Gasoline Prices, Sept. 2024-Feb. 2025, TrendLensTM

However, other factors—such as mass federal layoffs and office lease terminations—could counterbalance any increase in commuting-related travel. Time will tell.

Auto Care Association members can access national and regional Arity VMT through TrendLensTM. We have noticed a delay in USDOT publication of VMT data, so continue to take advantage of this valuable member benefit and resource. You can learn more about Arity here.

References

(1) “DC traffic backs up as 17K federal workers are expected at base with parking for 4,400”, Juliana Valencia, NBC 4 Washington, Feb. 10, 2025. Link to article.

(2) “Fired federal workers can find jobs in D.C. government, Bowser says”, Meagan Flynn, The Washington Post, March 5, 2025. Link to article.

(3) “Beyond the Capital: The Federal Workforce Outside the D.C. Area”, Partnership for Public Service. Link to article.

Welcome to the new YANG Effect! Your one-stop quarterly newsletter for all things Automotive Aftermarket contributed to and written by under-40 industry professionals.

More posts

Market Insights with Mike is a series presented by the Auto Care Association's Director of Market Intelligence, Mike Chung, that is dedicated to analyzing market-influencing trends as they happen and their potential effects on your business and the auto care industry.

More posts